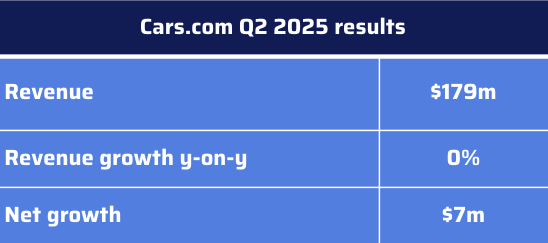

Cars Commerce, owner of the U.S. No.2 autos site, Cars.com, posted a profit but flat revenue in Q2 2025, with growth in car-maker ad sales offsetting a slight year-on-year dip in the company’s core dealership business.

Cars Commerce revenue fell just shy of $179 million, virtually unchanged from both the previous quarter and the year-ago quarter. Net income came to $7 million, down 38% y-o-y.

The company counted 19,412 dealer customers at the end of June, up more than 160 from the previous quarter, the best sequential increase Cars had enjoyed in three years. However, monthly average revenue per dealer was down about 2% y-o-y to $2,435.

National advertising, including from car makers, continued its upward trajectory from a low-point during pandemic factory slowdowns. National ads brought in 16.6 million in Q2, up 5% y-o-y.

The results disappointed investors, with CARS trading at $10.92 per share mid-morning Thursday, nearly 18% down from the previous day’s close.

Cars reported continued progress with its vehicle appraisal tool, Accu-Trade, acquired in 2022 with an initial investment of $65 million. Subscribing dealers, who numbered 1,070 at the end of June, conducted 925,000 appraisals with it in Q2, up 42% year on year.

The company also reported progress in the rollout of DealerClub, a wholesaling platform Cars acquired with an initial $25 million investment in January. Transaction volume was up 50% quarter-over-quarter alongside double-digit active user growth, the company said.

Cars.com had 26.6 million average monthly visitors in Q2, up 2% y-o-y. Average monthly visits were 162 million, also up 2%.

Although the company suspended guidance last quarter, citing unpredictable market conditions, it gave an outlook for low-single digit revenue growth for the second half of 2025.

“The Company continues to execute on 2025 growth initiatives, including driving product adoption and innovation, and broad-based repackaging,” Cars said in its Q2 earnings report. “However, as previously communicated, the favorability, magnitude, and timing of customer spending in certain product categories, such as advertising, is subject to market factors like vehicle production levels and affordability, which have been volatile year-to-date.”