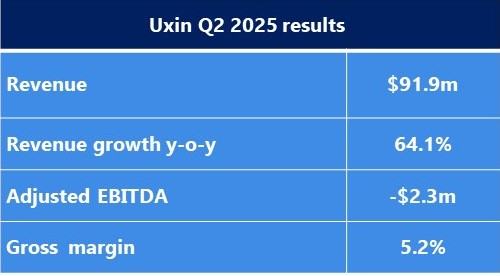

China-based hybrid auto retailer Uxin Limited has posted revenue of RMB658 million ($91.9 million) for Q2 2025, up 64.1% year on year (y-o-y), according to its unaudited financial report. Revenue growth was mainly driven by retail vehicle sales revenue, which rose by 87.0% y-o-y to RMB608 million in Q2 2025. Retail transaction volume surged 154% to 10,385 units. In contrast, wholesale vehicle sales revenue fell to RMB29.9 million in Q2 2025 from RMB63.9 million in Q2 2024. Wholesale transaction volume fell 19.4% y-o-y to 1,221 units in Q2 2025.

Cost of revenue was RMB624 million ($87.1 million) in Q2 2025, up from RMB376 million in the year-earlier period. Gross margin was 5.2% in Q2 2025, compared against 6.4% in the year-earlier period. The decrease was mainly due to the trial operation of Uxin’s new superstore in Wuhan, which commenced last February. As the store is still in the early stage of operation, it is currently in a gross profit ramp-up phase. The company expects that its overall gross margin will recover in the third quarter of 2025.

Uxin’s loss from operations was RMB43.1 million ($6.0 million) in Q2 2025, down by almost a third from RMB62.5 million in Q2 2024. Its adjusted EBITDA loss stood at RMB16.5 million ($2.3 million) in Q2 2025, down from a loss of RMB33.9 million in Q2 2024.

Uxin has incurred net losses since inception. In Q2 2025, the company incurred net loss of RMB67.6 million and operating cash outflow of RMB132 million, and its current liabilities exceeded current assets by approximately RMB202 million. As of June 30, Uxin had accumulated deficit in the amount of RMB19.7 billion ($2.8 billion).

Based on Uxin’s liquidity assessment, which considers the management’s plan to address these adverse conditions and events… the company believes that it is probable to meet its anticipated working capital requirements and other capital commitments and the company will be able to meet its payment obligations when liabilities that fall due within the next twelve months from the date of this release.

Going forward, Uxin expects its retail transaction volume to range between 13,500 units and 14,000 units. The company estimates that its total revenues including retail vehicle sales revenue, wholesale vehicle sales revenue and other revenue to range between RMB830 million and RMB860 million.