The long-running acquisition saga of Adevinta has reached completion. The multi-vertical marketplace specialist is now a private company under new ownership.

The consortium led by private equity firms Permira and Blackstone — called Aurelia Bidco Norway AS — now owns “approximately 94.79% of the share capital and 94.53% of the voting rights in the company,” according to a news release, after the voluntary offer for shares in the company was completed.

Adevinta stated, “As soon as reasonably practicable, the offeror intends to effect a compulsory acquisition of the remaining shares in the company not owned by the offeror at a redemption price equal to the offer price of NOK115 per share.”

The deal values Adevinta at NOK141 billion ($13.4 billion U.S.), making it the biggest marketplace transaction on record. The company was listed on the Oslo stock exchange.

Adevinta chairwoman Orla Noonan commented: “In the past six years, Adevinta has developed significantly as a business, consolidating its position as one of the leading online classifieds platforms and a European champion for sustainable commerce.

During this time, Adevinta was spun out of Schibsted, listed on the Oslo Stock Exchange and completed the transformational acquisition of the EBay Classifieds business. Now, under new ownership, it will become a private company.

Today, the other independent directors, Fernando Abril-Martorell Hernández, Julia Jäkel, Sophie Javary and Michael Nilles will also step down from the board.”

Adevinta owns and operates leading marketplaces, primarily across its six core Western European markets:

- Horizontal LeBonCoin.fr in France

- Horizontal Kleinanzeigen.de and auto vertical Mobile.de in Germany

- Horizontal Subito.it and auto vertical AutoMobile.it in Italy

- Real estate verticals Habitaclia.com and Fotocasa.es, horizontal Milanuncios.com, auto verticals Coches.net and Motos.net, and recruitment marketplace InfoJobs.net in Spain

- Horizontal 2EmeMain.be / 2DeHands.be in Belgium

- Horizontal Marktplaats.nl in the Netherlands

- Marketplaces in non-core markets, such as Kijiji.ca in Canada

- Significant joint ventures, including horizontal OLX-Brazil, WillHaben in Austria and the Distilled marketplace business in Ireland.

EBay, Schibsted cash out

Two major Adevinta investors have cashed out parts of their stakes in the company — U.S.-based ecommerce giant EBay and Norway-based marketplace operator Schibsted.

Schibsted has sold 60% of its 28.1% stake in Adevinta for approximately NOK24 billion in cash and will contribute its remaining Adevinta shares into an indirect parent company of the offeror, resulting in an approximate 13.6% indirect ownership in the new company.

EBay has sold its remaining shares in Adevinta for $2.2 billion U.S. in cash and 20% equity.

What does the future look like for Adevinta? One of the largest marketplace businesses in the world should be broken up, according to Steve Kooyers, a partner at private equity company Apax Partners.

Kooyers said that the buyers of Adevinta were probably “not thinking of it as a single company,” he told the audience at the AutosBuzz conference in Amsterdam in mid-May.

To justify the “hefty premium” they paid, the buyers will likely “have to take out costs,” he added. Kooyers cited Germany-based auto marketplace Mobile.de as an Adevinta subsidiary that was ripe for an IPO in the next 12-24 months.

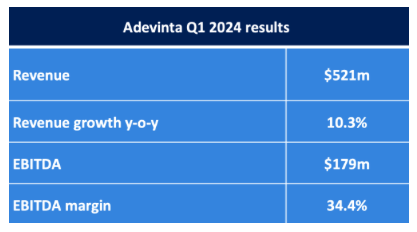

Operating revenue at Adevinta rose by 10.3% year on year (y-o-y) to €480 million ($521 million U.S.) during the first three months of 2024, while EBITDA increased by 13.8% to €165 million ($179 million). As a result, its EBITDA margin rose by 100 basis points from 33.4% in Q1 2023 to 34.4% in Q1 2024.